How to Leverage a Blue Ocean Strategy in Insurance

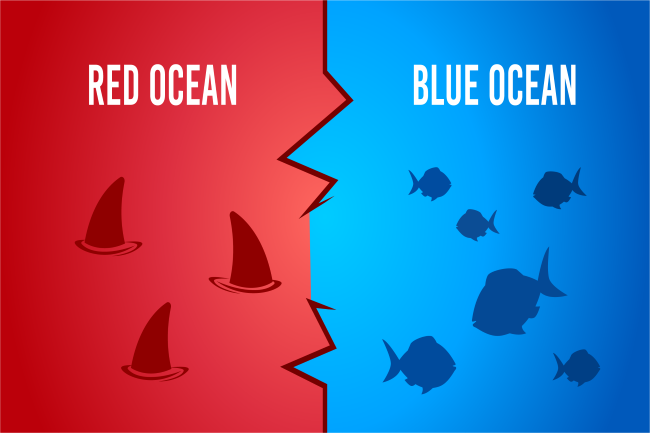

The insurance market is crowded. If you’re tired of battling against multiple competitors, consider a blue ocean strategy. What is a blue ocean? In simple terms, it’s a welcoming place with plenty of potential customers (fish) and very few competitors (sharks).

If You Can’t Beat ‘Em, DON’T Join ‘Em

You’ve heard the expression, “If you can’t beat ‘em, join ‘em.” It might be good advice in some situations, but when you’re trying to stand out in a saturated market, it won’t help you get ahead. Rather than joining the competition, you need to separate yourself from it.

That’s the basic idea behind the blue ocean strategy. According to Harvard Business Review, blue oceans are currently untapped market spaces. You can use a blue ocean strategy by creating a totally new industry or by expanding the boundaries of an existing one. Cirque de Soleil is a prime example: rather than trying to compete with other circuses – a dwindling market at the time – the founder reinvented the circus and created an entirely new market.

Applying the Blue Ocean Concept to Insurance

According to Investopedia, insurance can trace its roots back to ancient Babylonia and the Code of Hammurabi. Over the millennia since then, the idea has taken off – but this has meant the insurance market has become crowded.

You might assume there are no blue oceans left in a space as old as insurance, but that’s not the case. Insurance serves businesses of all types, and innovators are always creating new products, services and industries that require risk management services.

For example, not so long ago, the last mile delivery market didn’t even exist. Now, it’s expected to reach 357.45 billion by 2031 according to Global Newswire. Imagine where you might be if you had established a business focused on insuring last mile delivery businesses.

Even if you’re not focusing on one industry, you can leverage a blue ocean strategy by finding gaps in the existing market. You just need to uncover underserved needs, focus on niches, and think outside the box.

1. Uncover Underserved Needs

One of the best ways to carve out a market share is to identify underserved needs and find a way to meet them.

Think about the individuals and business owners in your community. Even better, don’t just think about them – get out in the community and talk to them. What insurance needs do they have that no one is meeting?

For example, individuals probably need personal cyber protection, and some agencies/carriers don’t offer that yet. Bingo! There’s a possible blue ocean.

What about property owners in CAT markets who can’t find coverage in traditional markets? Parametric insurance, a new way to protect property owners from catastrophic exposures, just might offer a blue ocean opportunity.

2. Focus on Niches

A recent article focused on how niche marketing can help you establish yourself. Instead of offering general services, you can specialize in a specific industry, line of insurance, or segment of the population.

Draw on your past experiences to find a niche you understand. If you grew up on a farm or ranch, consider the agricultural niche. If you play a particular sport or hobby, see if there is a possible related niche. For example, could you insure golf courses or sports teams?

Also, look at emerging industries like solar, lithium or cannabis, or changing environmental factors that are creating new industries, like wildfire suppression. Evolving laws and regulations can also create new risk management opportunities. Many cities are building their homeless services and transitional housing offerings – could that be a blue ocean?

3. Think Outside the Box

By paying close attention to what’s going on in the world, and the risk management implications, you can identify new, emerging markets that need help with insurance and risk management.

The whole point of a blue ocean strategy is to develop a space of your own and to become your own market of one, ideally. This means you can’t just follow the crowd: you must think outside the box and come up with a new idea.

If you need some help coming up with creative ideas, there are exercises you can try. BetterUp suggests several tactics, including asking someone outside your field, doing a “brain dump” of all your thoughts, asking a child, and working backward from the goal. Entrepreneur recommends setting parameters to focus your ideas.

Once you have a good idea, stress test it. Search online to see if potential competitors already exist. If so, find out their breadth and depth and if they’re already dominating the market. Talk to potential customers and find out who they trust for insurance and risk management. Ask them about their struggles and what they would like to see from an insurance partner.

Grow by Showcasing Your Thought Leadership

Once you find your blue ocean, you’ll need to promote business. In niche marketing, thought leadership is essential. You need to create content that showcases your unique knowledge and specialization.

- Create a website and sales collateral.

- Use social media marketing to widen your reach.

- Maintain a blog to provide educational content to your audience.

- Include decision trees, infographics, and other pieces of visual content to guide your audience through the buyer’s journey.

- Leverage case studies to show what you can do for clients.

- If you’re targeting other businesses, create a white paper to provide more in-depth education.

You might not need every type of content, but you will need a variety to appeal to prospects at different stages of the buyer’s journey. To identify the content types that will be most effective for your strategy, download the Content Marketing Roadmap.