Leveraging Content to Systematize the Insurance Sales Process

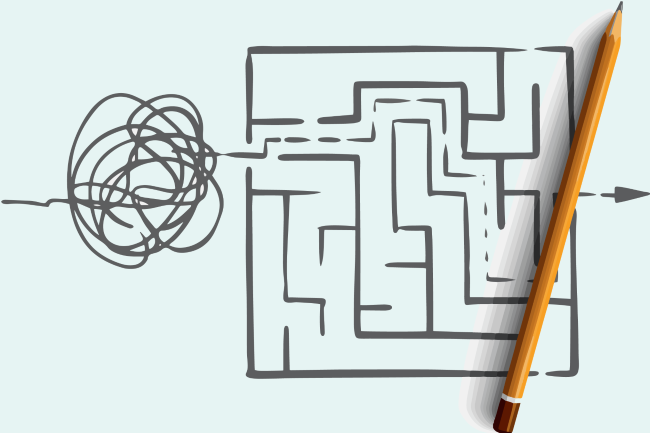

You’ve just made a sale. After you celebrate, do you (A) determine what you did right so you can repeat it in your next sales attempt or (B) start from scratch with your next sales attempt? Although (A) sounds like the obvious choice, you’d be surprised how many insurance sales agents reinvent the wheel with each lead. For better results, it’s time to leverage content marketing to systematize your insurance sales process.

How a Lack of Systematization Undermines Success

When your insurance sales process lacks systematization, you end up starting from scratch each time you follow a lead. This undermines insurance sales success in two major ways.

- First, you waste a lot of time. That’s time you could be spending finding new leads, following up with prospects or even enjoying some well-deserved time off.

- Second, your results are inconsistent. A lack of systematization means that your process is, by definition, inconsistent, and that produces inconsistent results. Even if you luck into a process that works, you’ll be back at square one with the next lead.

Why Sales Processes Often Lack Systematization

If a systematized approach is clearly superior, why aren’t all insurance sales agents using one?

One issue could be that insurance agents are afraid of sounding robotic. They want to come across as sincere and authentic, not rehearsed. While this is an understandable concern, it’s not a reason to avoid systematization. Sales scripts and templates only come across as unauthentic if they’re written poorly, and sales agents will always have room to customize materials and talking points.

A bigger issue is that many agents simply haven’t taken the time to create a systematized approach. When they need to email a lead, they don’t have a template, so they write an email then and there. When they need to call a client, they don’t have a script, so they wing it.

The truth is that is does take some time to come up with a systematic sales process and all the content required. However, in the long run, doing so will save you much more time.

How to Develop Your Own Systematic Insurance Sales Process

Creating your own systematic insurance sales process isn’t difficult. You just need to be, well, systematic about it.

1. Start by mapping a successful insurance buyer's journey.

Before you can create an efficient sales process, you need to understand your buyer’s journey. The buyer’s journey is the process that people go through, starting with when they become aware of the need for a product or service and ending with the decision to buy.

- What triggers the need for insurance? If you’re selling life insurance, the buyer’s journey could start when someone has a baby or buys a home and realizes they should have life insurance coverage. If you sell auto insurance, it could be when someone buys a car.

- How do buyers explore their options? They might meet with a broker, but there’s a good chance they conduct research online first.

- What are the most common questions that need to be answered?

- What are the most common objections that need to be overcome?

- What persuades buyers to make a purchase? Identify the points that most often trigger a decision to buy.

- Why do you lose sales?

Note that different types of customers, or buyer’s personas, can have different journeys, so may need to map several journeys.

2. Determine the common touchpoints.

Every touchpoint is an opportunity, so you want to be ready to seize it. To get ready, you need to anticipate all the common touchpoints. This could include:

- Personal emails (1:1)

- Marketing emails (1:Many)

- Letters and direct mail

- Social posts

- Social messaging

- Text Messages

- Phone Calls and Voicemails

- Events and conferences

- Milestones in the journey such as demos, quotes or proposals

- Quotes that you provide to people who have filled out online forms.

3. Plan the cadence of your outreach.

Determine the average number of touches needed to make a sale and the average timeframe typically required, and then determine your cadence for outreach.

4. Write email and letter templates.

Once you know the buyer’s journey and common touchpoints, you can start developing templates. These templates should make the points that you’ve found to be most persuasive at different phases of the buyer’s journey. That way, producers are always putting their best foot forward. Use your templates to hyperlink to helpful content in your blog or the resource area of your website.

The templates should be set up in your CRM system so agents can customize and use them easily.

5. Provide sales handouts and other resources to support each phase of the journey.

Sales handouts are powerful tools that can help boost the productivity of your agents. You should develop sale handouts for each phase of the buyer’s journey, and you should have multiple options to fit different buyer’s personas and types of decision-makers. For example, if you’re selling life insurance, some handouts may be geared toward parents, while others may be geared toward business owners. Likewise, some may be geared toward analytical decision-makers, and others may be geared toward emotional decision makers. This Content Road Map provides ideas.

6. Work with a successful advisors to build sales scripts and sales decks.

Even if your more successful agents haven’t actually written out a sales script, they likely have makings of a script in their minds. Work with them to write a sales script that less experienced agents can follow. Also, standardize a sales deck. Along with the sales handouts that you’re providing, these tools will help all advisors reach their full sales potential.

7. Provide follow-up templates and paper thank you notes.

Various studies have shown that it takes at least seven or more follow ups to make a sale, and that the number of follow ups needed increases when higher budgets and multiple stakeholders are involved. Nevertheless, many advisors give up after one rejection.

Follow-up is essential, but sales professionals may be unsure of how to follow up without coming across as pushy or annoying. You can help them by providing guidance on how to overcome objections. Your toolkit should include educational pieces that are targeted to address certain objections, follow-up communication templates and paper notes.

8. Train agents to share company social posts and blog articles.

You want to get more eyes on your company’s social posts and blog articles. Your agents need content to post on their own social media accounts and websites. When you enlist your team in your content distribution, it’s a win-win.

Encourage your team to share your content on their own websites and social media feeds, and make it easy by providing them with posts and links. Not only does this help raise brand awareness for your company, but it also helps your agents educate their prospects and stay top of mind.

9. Create social selling expectations.

Most of your agents likely have social media accounts, but they may not be active users. This is a problem. According to HubSpot, 47% of buyers look at three to five pieces of content before talking to a salesperson, and social media is the number one marketing channel.

If your agents aren’t active on social media, they’re missing out on opportunities to connect with buyers. Help them conquer LinkedIn with a LinkedIn action plan.

With a systematic insurance sales approach, all your sales professionals can achieve more consistent results without wasting time and suffering from burnout. If you need help putting together the content you need to fuel your sales process, Inbound Insurance Marketing can help. Contact us to learn more.